All Categories

Featured

Table of Contents

Choosing to purchase the property market, supplies, or various other standard kinds of possessions is prudent. When deciding whether you must buy accredited capitalist opportunities, you need to balance the compromise you make in between higher-reward prospective with the absence of reporting requirements or governing transparency. It should be said that private positionings require higher levels of danger and can on a regular basis stand for illiquid investments.

Particularly, absolutely nothing here should be analyzed to state or indicate that past outcomes are an indication of future performance neither need to it be translated that FINRA, the SEC or any type of various other protections regulator authorizes of any one of these protections. In addition, when evaluating personal placements from sponsors or firms supplying them to accredited capitalists, they can supply no warranties expressed or indicated regarding accuracy, efficiency, or results obtained from any type of details given in their conversations or presentations.

The business ought to give details to you via a paper called the Personal Positioning Memorandum (PPM) that supplies a more detailed description of expenses and dangers connected with taking part in the investment. Rate of interests in these bargains are only supplied to persons who certify as Accredited Investors under the Stocks Act, and a as defined in Section 2(a)( 51 )(A) under the Business Act or an eligible employee of the management firm.

There will not be any type of public market for the Interests.

Back in the 1990s and very early 2000s, hedge funds were known for their market-beating performances. Some have underperformed, specifically throughout the financial situation of 2007-2008. This alternative investing approach has an one-of-a-kind means of operating. Normally, the supervisor of an investment fund will certainly reserve a part of their offered assets for a hedged wager.

Who has the best support for Commercial Property Investments For Accredited Investors investors?

For instance, a fund manager for an intermittent sector may dedicate a portion of the assets to supplies in a non-cyclical market to offset the losses in case the economy storage tanks. Some hedge fund supervisors utilize riskier techniques like making use of obtained money to purchase even more of a property merely to multiply their possible returns.

Comparable to mutual funds, hedge funds are expertly handled by occupation investors. Hedge funds can use to various investments like shorts, alternatives, and by-products - Commercial Property Investments for Accredited Investors.

Who offers the best Accredited Investor Real Estate Investment Groups opportunities?

You may pick one whose financial investment approach straightens with your own. Do bear in mind that these hedge fund cash supervisors do not come economical. Hedge funds normally charge a charge of 1% to 2% of the assets, in enhancement to 20% of the profits which acts as a "performance charge".

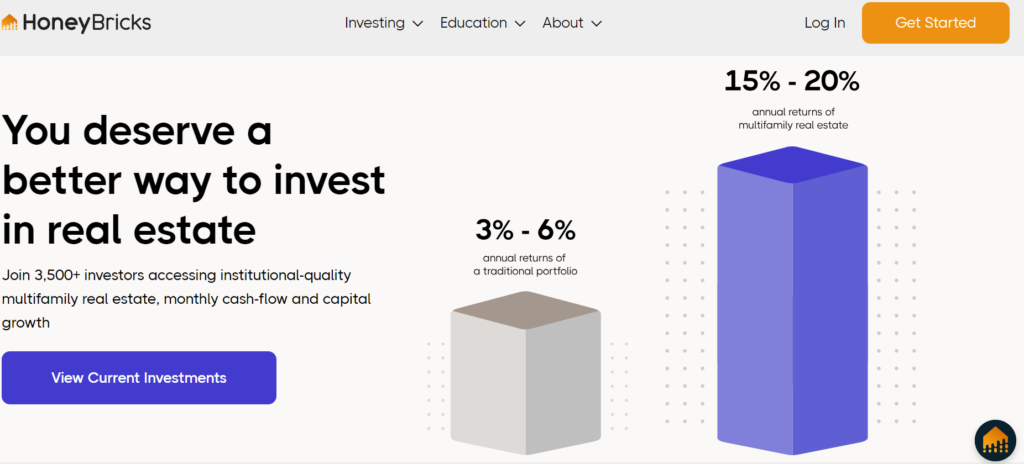

High-yield financial investments bring in many capitalists for their cash money circulation. You can buy an asset and get awarded for keeping it. Approved investors have a lot more possibilities than retail capitalists with high-yield financial investments and beyond. A higher range offers certified capitalists the chance to obtain greater returns than retail investors. Approved financiers are not your ordinary investors.

How long does a typical Real Estate Investing For Accredited Investors investment last?

You need to satisfy at least among the adhering to parameters to come to be a recognized capitalist: You need to have over $1 million web well worth, excluding your primary home. Service entities count as accredited investors if they have more than $5 million in assets under monitoring. You have to have a yearly revenue that goes beyond $200,000/ yr ($300,000/ yr for partners submitting together) You must be a registered investment advisor or broker.

Consequently, approved capitalists have a lot more experience and cash to spread out across possessions. Certified investors can seek a broader series of assets, yet much more choices do not guarantee higher returns. Many investors underperform the marketplace, including recognized capitalists. In spite of the higher status, accredited capitalists can make considerable errors and do not have accessibility to insider details.

In enhancement, capitalists can construct equity via positive money circulation and home gratitude. Real estate properties require significant maintenance, and a whole lot can go incorrect if you do not have the best team.

What does Real Estate Investing For Accredited Investors entail?

Genuine estate organizations merge cash from recognized capitalists to buy buildings lined up with well-known objectives. Accredited investors merge their money with each other to finance acquisitions and residential property development.

Real estate investment trust funds need to disperse 90% of their taxed revenue to investors as rewards. You can purchase and offer REITs on the supply market, making them extra liquid than most investments. REITs enable investors to branch out swiftly across several residential property classes with really little capital. While REITs also transform you right into a passive investor, you get even more control over important choices if you sign up with a real estate organization.

How do I choose the right High-return Real Estate Deals For Accredited Investors for me?

Financiers will profit if the stock rate rises given that convertible investments give them more appealing access points. If the supply topples, capitalists can choose versus the conversion and safeguard their financial resources.

Table of Contents

Latest Posts

Struck Off Property

Paying Taxes On Foreclosed Property

Unclaimed Tax Overages

More

Latest Posts

Struck Off Property

Paying Taxes On Foreclosed Property

Unclaimed Tax Overages