All Categories

Featured

Table of Contents

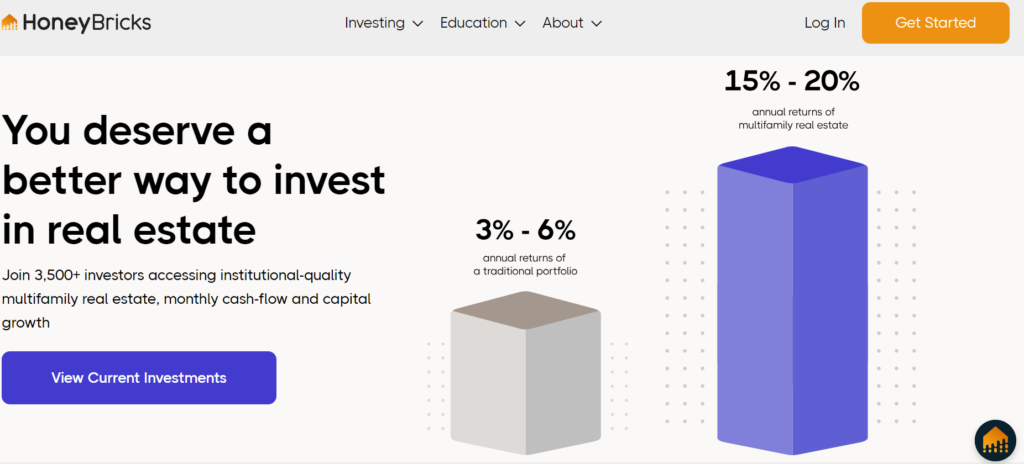

These alternate financial investment systems allow you to check out actual estate, startups, and tech alternatives also. By making use of these systems, new financiers can learn more about several kinds of investment alternatives while obtaining real-life experience. Keep in mind to heavily vet the companies before spending as crowdfunding is not heavily managed and is riskier than conventional investment sources.

All investments are risks yet with the appropriate support, you can have a lot more self-confidence in your decisions. Not all investments have the same timelines, rewards, or threats.

Due persistance is the finest way to recognize the investment, the enroller, and the risk aspects. If a sponsor isn't going to go over danger, incentive, and timelines, that is a warning. Successful Non-Accredited Financier Participation- Some business supply the ability to spend together with them such as This firm permits retail investors to acquire passive earnings by utilizing their system to invest with an equity REIT.

Real Estate For Accredited Investors

Crowdfunding is open to all capitalists yet non-accredited are managed on investment amounts based on earnings. Exception 506 B- enables up to 35 advanced unaccredited capitalists to get involved along with approved capitalists.

To stay compliant they must adhere to laws regulating exclusive placements found in. Compliance Demands for Syndicators- Restricts syndicate referral payments for any person apart from SEC-registered brokers Non-accredited capitalists get additional disclosures Enrollers need to give using records Capitalist Security Procedures- The laws secure financiers from fraud and make certain that openly traded firms offer exact financial details.

Attaching realty crowdfunding platforms can be an appealing option to acquiring property the typical method. It lets you pool your cash with various other financiers to go in on offers you could not access otherwisesometimes for as little as $10 (Residential Real Estate for Accredited Investors). It also makes expanding your property portfolio across several residential or commercial properties very easy

Capitalists take advantage of residential property recognition, understood at the end of the holding period, and regular rental revenue, dispersed quarterly. As with many realty, Showed up considers its residential or commercial properties lasting financial investments. Holding periods are typically 5-7 years for long-term services and 5-15 for getaway services. The platform does not enable individuals to exit their financial investments before the holding period is over.

Accredited and non-accredited capitalists can after that get shares of buildings for just $100. The business aims for 12- to 24-month long-term leases and utilizes major booking websites like Airbnb and VRBO for short-term services. To generate income, Arrived consists of a single sourcing cost in the share rate (3.5% of the home acquisition rate for lasting services and 5% for holiday rentals).

What is the most popular Exclusive Real Estate Deals For Accredited Investors option in 2024?

Furthermore, some residential properties are leveraged with a mortgage (normally 60-70%), while others are acquired with cash. All mortgages are non-recourse, implying capitalists aren't accountable for the debt and do not need to qualify for credit. Each residential property is housed in a Collection LLC to safeguard investors versus personal obligation and the off chance that Got here ever goes out of company.

You can additionally access your account by means of an Apple application (presently, there's no Android app, yet the business plans to release one in 2024). The company site has a chatbot for asking Frequently asked questions and sending out messages, which it usually responds to within a day. The website additionally lists a support e-mail address yet no contact number.

Why should I consider investing in Real Estate For Accredited Investors?

With the exception of a exclusive REIT, the firm does not sponsor its very own deals. Rather, it lets realty enrollers use to have their offers vetted and noted on the platform. Once moneyed, financial investments are after that managed by the initial enroller. CrowdStreet offers all sorts of commercial realty financial investments: multifamily, retail, workplace, clinical building, self-storage, commercial, and land opportunities.

According to the company, equity financiers typically gain quarterly dividends as a share of earnings, while financial debt financiers make quarterly returns at an agreed-upon interest. Nonetheless, distributions aren't assured, and in some cases returns aren't understood up until the building offers. There is almost no choice to redeem your capital or leave your investment before the hold period ends.

Crowdstreet charges real estate sponsors fees for using the platform. Those fees decrease investor distributions. Additionally, enrollers likewise take charges as part of the bargain, which can vary by bargain, yet commonly consist of an acquisition charge and administration charge, among others. Each financial investment's charge structure is disclosed on the website, and users can log in to track their investment's efficiency.

Compared to other platforms, CrowdStreet has a high barrier to entrance. It's only available to recognized investors, and the minimum investment for the majority of offers (consisting of the exclusive REIT) is $25,000. Customers can make offers, track their investment performance, and communicate straight with sponsors with an on the internet site, but no mobile application.

How do I choose the right Residential Real Estate For Accredited Investors for me?

The company internet site has a chatbot for asking Frequently asked questions or sending messages as well as a call email address. According to the company site, as of 20 October 2023, CrowdStreet creators have spent $4.2 billion throughout over 798 deals, of which 168 have been understood.

It detailed its initial fractionalized home deal online in 2012. Considering that after that, the company has relocated to a private REIT version. Individuals can select between financial investment strategies that prefer long-lasting appreciation, additional earnings, or a mix of both.

We recommend Fundrise if you want a truly easy spending experience.: one that focuses on creating regular monthly rewards for investors and one more that targets lasting capital appreciation.

Depending on the bargain, investors can generally expect holding durations of 3 to 7 years. Leaving your investment prior to the end of the hold period or reselling it isn't feasible. Some are readily available to non-accredited capitalists for a $500 minimal financial investment, while others are just open to recognized investors and have minimum investments of up to $50,000.

Table of Contents

Latest Posts

Struck Off Property

Paying Taxes On Foreclosed Property

Unclaimed Tax Overages

More

Latest Posts

Struck Off Property

Paying Taxes On Foreclosed Property

Unclaimed Tax Overages