All Categories

Featured

Table of Contents

In a lot of cases, you will have to outbid other capitalists by offering to pay a higher premium (tax lien foreclosure process). This premium is normally much less than the actual amount of taxes owed, yet it's up to the investor to determine if the danger is worth the collection reward. In many places, residential property taxes are around one percent of the home's value

Tax obligation lien investors make their money on the passion settlements they collect when the house owner pays back the taxes they owe. In some areas, these rate of interest are as high as 18 percent, which is greater than the ordinary charge card rates of interest. Homeowner can pay what they owe simultaneously, or they can take place a payment strategy ranging from one to three years.

How To Invest In Real Estate Tax Liens

In the above example, somebody with an exceptional tax obligation financial obligation of $4k (two years of back tax obligations) would certainly be offering a tax obligation lien holder with possibly approximately $720 in rate of interest payments, collaborating with the 18 percent rates of interest we pointed out previously. One of the best benefits to tax lien capitalists is the prospective to get a new residential or commercial property for their actual estate profile, without having to pay its market price.

This is a method that several investor use to get underestimated homes or distressed properties. And if the property proprietor does pay their financial debts, they will still earn a profit in the kind of rate of interest. It's a great deal for the tax lien investor. There are some cons to tax obligation lien investing.

As soon as the lien is paid, the capitalist should proceed and search for a new financial investment. Obviously, if the homeowner is still in default, the lien owner will get the building, which can become a persisting resource of revenue. A person that buys a tax lien may discover themselves knotted with other liens on the building, particularly if they end up asserting the residential or commercial property in case the financial obligation goes unsettled.

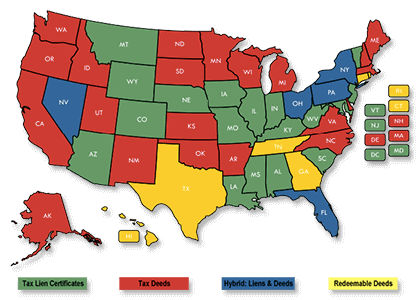

This can lead to great deals of lawful battles, which is why it is very important to deal with lawyers and tax obligation advisors who understand things like action vs title. and can assist with executing due diligence on a residential or commercial property. The regulations around tax lien investing (and associated issueslike foreclosing on renters) are not uniform throughout states that provide investors the capability to take part in a tax lien sale.

Considered that tax liens are frequently marketed at auction, competing bidders will certainly bid up the premium and bid down the rate of interest price that can be accumulated on the overdue taxes. The winner of the public auction will certainly be the investor who is paying the highest possible costs and obtaining the most affordable interest rate in return.

Is Tax Liens A Good Investment

In this capillary, tax obligation lien investing is a little a lot more sport-like than conventional passive means of earning income. The first point you'll intend to do is get aware of the area you're thinking about in terms of the genuine estate market. Bear in mind that one upside of coming to be a lienholder is collecting the building if the financial debt goes overdue, so you will need to know where that property is.

Once you've identified these information out, you need to call your neighborhood area treasurer's office to find out when and where the next tax lien public auction is being held. These public auctions are frequently kept in person, but in today's day and age, a lot of have transitioned to on the internet locations.

The majority of regional papers release these lists every year or semiannually. Keep in mind that building tax obligations are usually one percent of the building worth, but overdue taxes building up over a number of years might be an extra sizable quantity.

Investing In Tax Liens In Texas

it has the included perk of obtaining the property if the financial debt continues to be overdue. While it can be a lucrative chance for the financier, it does require some tactical maneuvering. Occupants and residential or commercial property owners do have lawful securities that make tax obligation lien investing a much more involved process than just bidding to acquire a financial debt and waiting to gather the payment.

Spending in tax liens entails purchasing a lawful case on a property due to overdue real estate tax. This method of investing has actually obtained appeal because of its possibility for high returns with reasonably reduced initial capital. Tax obligation liens are generally cost public auctions, and the process can vary depending on the place.

Financiers seek tax liens for a number of reasons: 1. Low First Investment: Tax obligation lien spending frequently needs a small amount of cash to begin, making it available to a wide variety of capitalists. Some tax obligation liens can be purchased for as little as a couple of hundred bucks. 2. High Returns: The rate of interest prices on tax liens can be significantly greater than typical financial investment returns.

Tax Lien Investing

Home Purchase: If the building proprietor fails to pay the overdue taxes and passion within the redemption period, the financier might have the right to seize and obtain the residential or commercial property. When investors buy a tax lien, they pay the overdue tax obligations on a residential or commercial property and receive a tax lien certification.

There are 2 possible outcomes: 1. Payment by the Homeowner: The homeowner repays the past due tax obligations plus passion within a specified duration, and the financier receives the settlement with rate of interest. This is one of the most usual end result. 2. Foreclosure: If the homeowner does not pay back the taxes within the redemption period, the financier can start repossession procedures to acquire the property.

The self-directed IRA acquisitions the lien certification and pays associated charges. Tax Lien: The government offers a lien on the building due to overdue taxes.

How Do You Invest In Tax Liens

Tax Action: The federal government markets the real action to the residential or commercial property at auction. According to the National Tax Obligation Lien Association (NTLA), 36 states and 2,500 jurisdictions within the United States allow for the sale of tax liens, while just 31 states permit tax obligation action sales.

Table of Contents

Latest Posts

Struck Off Property

Paying Taxes On Foreclosed Property

Unclaimed Tax Overages

More

Latest Posts

Struck Off Property

Paying Taxes On Foreclosed Property

Unclaimed Tax Overages